Financial aid is funding that helps you cover the cost of college! It can come in many different forms, like scholarships, grants, loans, or work-study opportunities. Westmont provides generous scholarships and financial aid, and we are committed to work with you to help make a high-quality education affordable. Your actual cost to enroll depends on your family’s financial need, along with your eligibility for merit-and talent-based scholarships.

The 2025-2026 FAFSA is now open to all students and families! By submitting your FAFSA as soon as it is available, you can make sure you receive the maximum amount of financial aid. Be sure to add Westmont to your list of schools!

If you have any questions, please feel free to contact Student Financial Services by calling (805) 565-6063 or by emailing sfs@westmont.edu.

Net Price Calculator

Many students find that their cost of attendance at Westmont is 25-50% lower on average than our sticker price. Check out our new Net Price Calculator, designed to help you receive a personalized estimate in less than five minutes!

Gain an Affordable Education

We want to work with you to make college affordable. Westmont provided $39 million in grants and scholarships last year, assisting 95 percent of our students. Money’s 2023 Best Colleges rating, which analyzed more than 700 four-year colleges with a focus on quality, affordability and student outcomes, recognized Westmont with four-out-of-five stars. LendEDU ranks Westmont highly in California for helping students afford tuition. Our four-year graduation rate (72 percent) exceeds the four-year national graduation rate (48 percent) by 24 percentage points and the six-year national graduation rate (64 percent) by eight percentage points. Twenty-one percent of Westmont students graduate early.

95%of new students at Westmont | 2024-2025 COSTSTuition | $52,320 Fees | $1,264 Room | $10,100 Board | $6,860 | Westmont gives away half a milliondollars in financial aid every week. |

Scholarships

These merit-based awards are based on academic, athletic, and artistic ability.

Grants and Loans

Grants are gifted aid for students who exemplify extreme financial need. Loans allow students to borrow funds that must be repaid usually with interest.

Student Employment

Federal Work-Study (FWS) provides employment and community service opportunities for students who are eligible for need-based financial aid.

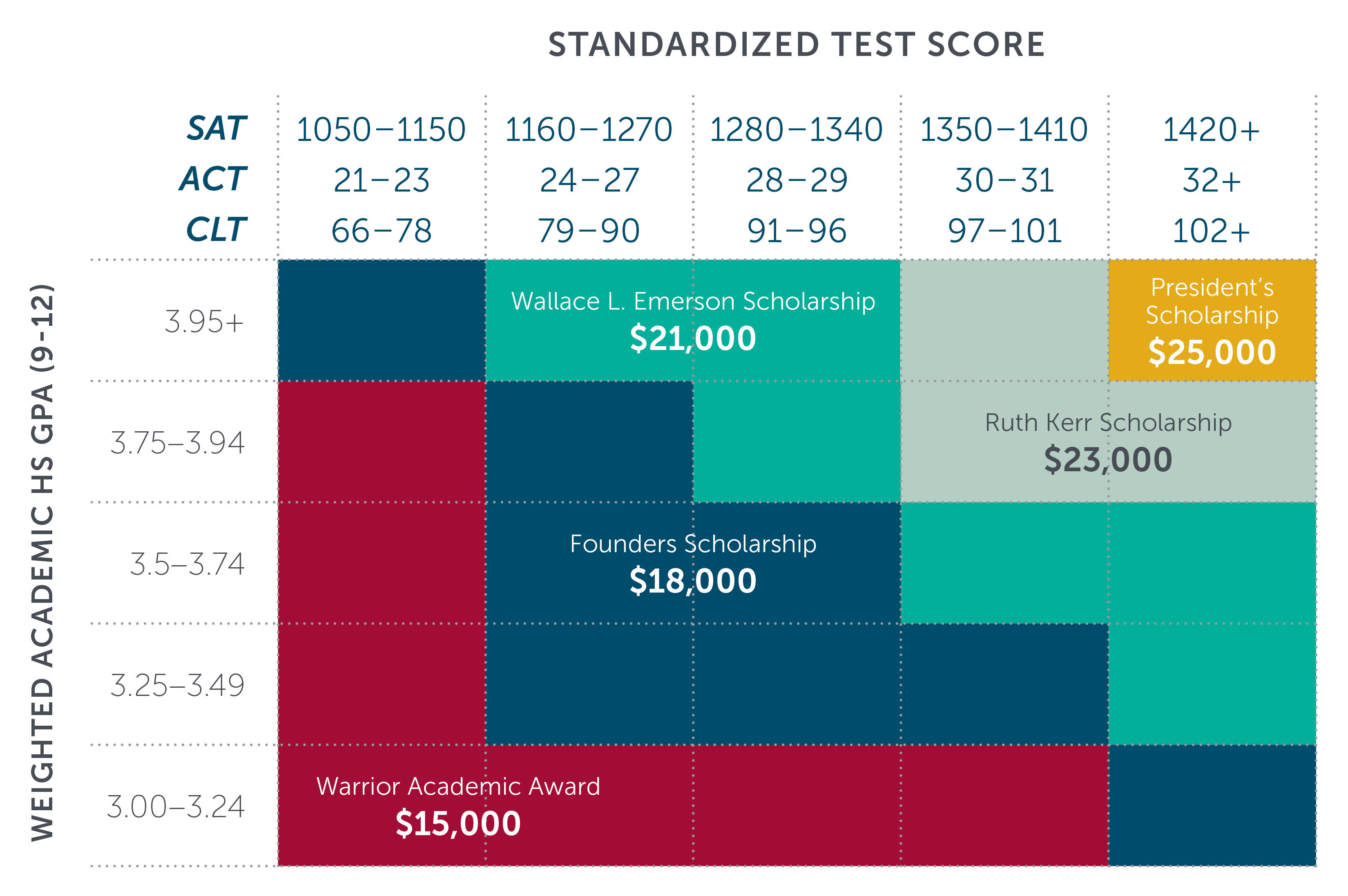

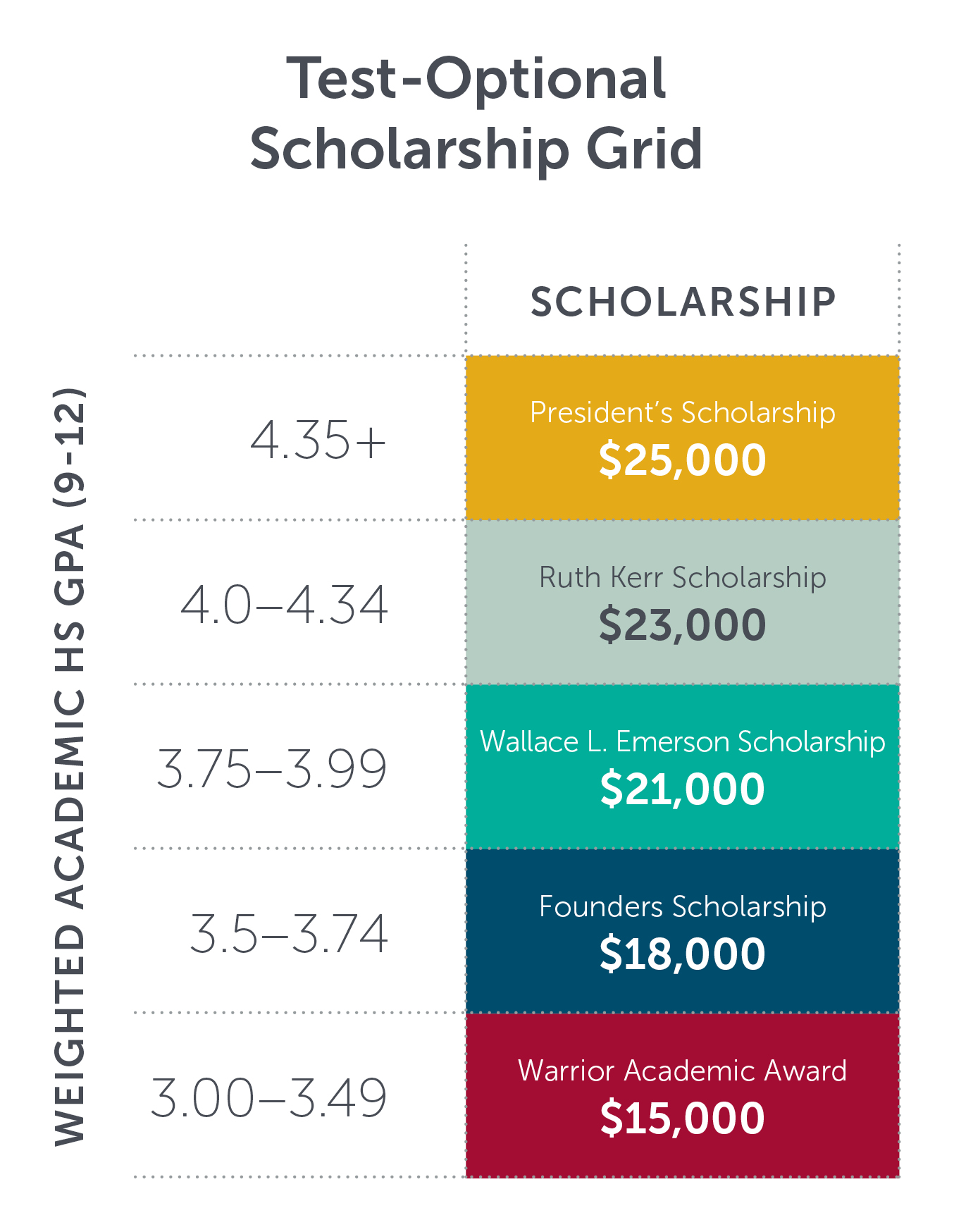

See Your Scholarship Eligibility at a Glance

Westmont offers generous academic scholarships, automatically awarded at the time of admission if you qualify. See the charts below to find out which scholarship you may be eligible for. As a test-optional school, we do superscore and only consider your test score if it benefits your application. These academic scholarships can be combined with any other need-based aid or talent scholarships you receive!

Steps to Apply for Financial Aid

Federal Student Aid ID

A Federal Student Aid ID is used to sign the FAFSA on the Web, as well as to make corrections, complete a renewal FAFSA, and to check on the student loan data. Parents of dependent students must also apply for a Federal Student Aid ID in order to sign their student's FAFSA renewal or corrections.

We encourage all students and prospective students to file the Free Application for Federal Student Aid (FAFSA). The FAFSA is completed online. This year's FAFSA is now OPEN for submissions to all students and families. Students that are applying for the Cal Grant need to fill out the FAFSA by March 3, 2025.

Submit FAFSA

With the upcoming changes to the FAFSA, Westmont is continuing our commitment to helping students and families make a Westmont education affordable.

We encourage all students and prospective students to file the Free Application for Federal Student Aid (FAFSA). The FAFSA is completed online. This year's FAFSA is now OPEN for submissions to all students and families. Students that are applying for the Cal Grant need to fill out the FAFSA by March 3, 2025.

The Federal School Code for Westmont College is: 001341

Cal Grant GPA Verification Form

California residents are eligible to apply for a Cal Grant. First-time Cal Grant recipients must have their high school GPA (or college GPA, for transfer students with 24 or more completed college semester units) submitted electronically to the California Student Aid Commission. Most High Schools submit the GPA automatically to the California Student Aid Commission, but the student should make sure this was done. The deadline to submit the GPA to the California Student Aid Commission is March 3, 2025.

Verification

Student Financial Services may request various documents to verify your information provided on the FAFSA. The list of required documents specific to your application will be available on the Financial Aid Student Portal (Net Partner). Financial aid awards are subject to change if information on these forms is different from the information reported on the FAFSA. Priority is given to students whose documents are received by June 1st.

Academic Transcripts for Transfer Students and Recent High School Graduates

Recent high school graduates must submit the final transcript that indicates graduation to the Office of Admission before financial aid will be credited to the student’s account. For transfer students, academic transcripts, through the final semester/quarter, must be submitted to the Student Records Office before Student Financial Services can verify a student’s eligibility for student loans.

Respond to your Financial Aid Package

Once all necessary financial aid application items have been submitted and reviewed by Student Financial Services, students will be sent an email indicating that the “final” financial aid package is ready to be reviewed. At that time, students must access the Financial Aid Student Portal and select “Accepting Your Aid” under the menu. Once there, a student is required to either accept or decline each source of financial aid that is listed. No financial aid will be credited to a student’s account until each fund offered has either been accepted or declined.

A PLUS loan, or Parent Loan for Undergraduate Students, is a federal student loan program in the United States that allows parents of dependent undergraduate students to borrow funds to help cover the cost of their child's education.

Worth the Investment in Your Education

The value of Westmont lies in educating the whole person and caring about every aspect of your life. You’ll find a home in a loving, hospitable community on a beautiful Santa Barbara campus that nurtures your mind, your faith, your character, your purpose, your future and your joy.

Scholarship Stories

How I Graduated |

Paying It |

Connect With Your Counselor

Have a more general admissions-related question? Your counselors would love to help. Find out who your counselor is and how you can reach out via phone, email, and even meet with them in person when you visit campus or at your local college fairs.

Contact Us

Our office is responsible for processing all payments for tuition, room, board, miscellaneous fees and financial aid. We are dedicated to helping students and families make the undergraduate experience affordable by stewarding the college's resources in a way that promotes fairness and takes into consideration the needs of the entire student population. If you have questions, call us at (805) 565-6063 or email us at sfs@westmont.edu.